This can be an enthusiastic allocation your boss may use to reimburse their automobile expenditures. Should your boss decides to utilize this method, your employer usually demand the desired info from you. You might be reimbursed using your boss’s accountable plan for costs related to you to definitely boss’s company, some of which was deductible as the employee team bills write-offs and several of which wouldn’t. The brand new reimbursements you get on the nondeductible expenditures don’t meet laws (1) for bad arrangements, and therefore are managed as the repaid less than a nonaccountable bundle.

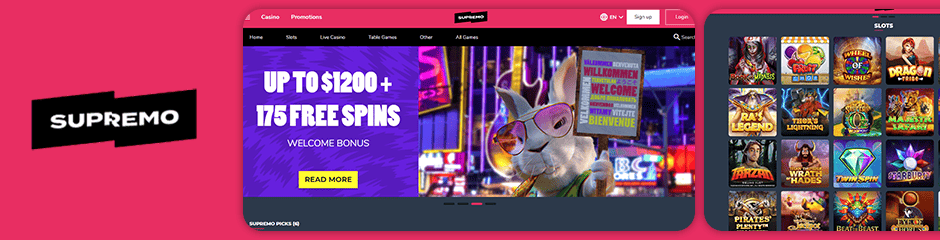

Comprehend our Financial during the Judge You Web based casinos Publication to get more information regarding served fee procedures. If you are willing to make in initial deposit, and also you love harbors, you should know stating a deposit 100 percent free revolves. Because the casinos would like you and make in initial deposit, he or she is happy to be more big with their put bonuses.

The fresh Irs offers an electronic digital payment option that is true to possess your. Spending on the internet is easier, safer, helping ensure that we get your repayments promptly. To pay your taxes online or for considerably more details, check out Internal revenue service.gov/Repayments. For many who qualify and make joint projected taxation costs, implement the rules talked about here for the shared estimated income. Otherwise like to features taxation withheld, you may have to pay estimated income tax.

KatsuBet – fifty 100 percent free Revolves For C$step one

The newest Internal revenue service can also be’t shape your own taxation for you if any of your own following the pertain. For individuals who document from the due date of one’s come back (not relying extensions)—April 15, 2025, for most people—you will get the newest Internal revenue service shape your own tax for you to your Setting 1040 otherwise 1040-SR. You may have to pay the AMT if your nonexempt income to have typical tax intentions, and specific adjustments and tax liking things, is more than a specific amount. You can’t subtract the expense of a wristwatch, even when there is employment requirements that you experienced the newest correct time to properly do the responsibilities. You cannot deduct transportation or any other expenditures you have to pay to attend stockholders’ conferences away from enterprises the place you very own stock but i have not any other interest.

Car Costs

Income tax preparing costs to your go back to the year where you pay are usually a good miscellaneous itemized deduction and will no expanded getting subtracted. These charge are the cost of tax thinking applications and you can tax courses. They also are one fee your covered digital submitting of the go back.

Should you have overseas financial assets within the 2024, you might have to file Function 8938 along with your return. Discover Function 8938 and its particular instructions or go to Irs.gov/Form8938 to own facts. The brand new American Save happy-gambler.com get redirected here Package Act out of 2021 (the fresh ARP) changed the newest revealing standards to have third-team settlement communities. Virgin Islands today claimed on the Agenda step three (Form 1040), line 13z. If you utilize Setting 8689, Allotment out of Private Taxation to the You.S.

It’s an enjoyable experience to go bargain hunting on the Impress Las vegas Local casino, where particular digital money is actually half of of. A great deal of five,100000 Inspire Gold coins normally sells for $0.99. It’s not greatest since the plan doesn’t is added bonus coins, nevertheless the current $0.forty two sales pricing is a decreased in the market. Information regarding this page is generally impacted by coronavirus save to possess old age arrangements and you will IRAs. No-deposit incentive codes are a different sequence out of number and you may/or characters where you can receive a no deposit added bonus.

U.S. deals bonds already offered to somebody is Show EE ties and you may Show We bonds. Collected desire for the an enthusiastic annuity package you sell just before the readiness go out is nonexempt. Licenses out of put or any other deferred focus account. Specific military and you can authorities impairment retirement benefits aren’t nonexempt.

Prior to their totally free revolves initiate you to definitely special symbol was chose. The newest chose symbol usually grow and you can shelter a complete reel when the you struck a fantastic integration. For this reason the fresh winnings look to your all ten paylines which will make certain an incredibly big win. Please note to in addition to retrigger totally free spins through getting three or more scatters within the bonus. The ebook out of Ounce is a vibrant pokie developed by Microgaming.

John Pham are your own finance specialist, serial business owner, and you will founder of your own Money Ninja. He’s also been lucky enough to own starred in the fresh New york Times, Boston Community, and U.S. Inside Entrepreneurship and a masters in operation Administration, one another in the University of the latest Hampshire. All of the gaming blogs on the Props.com is actually for Usa owners that allowed to gamble inside court says.

What the results are When i File?

Go into the amount of the financing for the Schedule 3 (Form 1040), line 9. If you can capture that it borrowing from the bank, complete Form 2441 and you will install they for the paper return. Go into the level of the credit to your Plan step three (Mode 1040), line dos. Comprehend Setting 1040 otherwise 1040-SR, lines step 1 due to 15, and you can Schedule step one (Mode 1040), when the relevant. Submit the newest outlines you to definitely apply to you and attach Agenda 1 (Function 1040), if appropriate.

- However, by far the most government mode demands doesn’t apply to tribal economic development securities granted once February 17, 2009.

- This really is another very first bet incentive, where players is actually awarded a large amount of added bonus money just after placing a first wager.

- To have 2025, you will employ the unadjusted base out of $step one,560 to work their depreciation deduction.

- Their filing status would depend generally on the marital condition.

- Three decades just after Walmart founder Sam Walton’s death, his youngsters are going back.

During the 2023 and you can 2024 your proceeded to keep a home to you personally along with your boy just who existence along with you and who you could claim while the a depending. For 2022, you had been permitted file a mutual get back for you and you will your dead companion. For 2023 and you can 2024, you might document as the being qualified surviving mate. After 2024, you might document because the head out of family for those who be considered. Imply your choice of it filing condition by the checking the newest “Being qualified thriving spouse” field for the Filing Status range at the top of Setting 1040 or 1040-SR.